Colorado College has an endowment of approximately $804 million. The full-pay cost for the 2020-21 academic year was $74,256. Why is the sticker price for CC (and higher education as a whole) so high when our endowment is well over half a billion dollars? This is a question that frustrated me for years as a student, until I learned more about the nuts and bolts of CC’s financial model.

Now, in my role as student trustee, I am learning more about financial planning. The Board of Trustees focuses on long-term implementation, ensuring that the college is in a strong financial position for years to come. During open office hours with fellow students this fall, I have had some enriching conversations with my peers, and I’m excited to share some highlights from these conversations.

What makes Colorado College a nonprofit?

CC, and nearly all higher education institutions, are nonprofits. We have costs (paying faculty and staff, offering financial aid, campus maintenance, constructing buildings for classrooms, etc.) and revenue (tuition, room, and board fees; money earned from the endowment; and annual gifts and grants), but not profit. There is no owner of CC who cashes out when we have a successful year, nor is there a group of shareholders interested in making money who run the school (most for-profit companies have one or both of these). On the contrary, the Board of Trustees works together to support the college’s growth. Trustees do not make money — we are volunteers and donors who give financial contributions to the school every year.

How does the endowment work?

Let’s say a donor gives a nonprofit a $100 gift. The donor and the nonprofit want to make the gift last, so rather than spending it all at once, they invest the $100 through the endowment and spend only $5 of the earnings each year. If the nonprofit received a donor gift to spend immediately, the original $100 gift would run out in 20 years ($100 divided by $5 per year equals 20 years). If, however, the nonprofit invests the principal $100 into the stock market, the principal can earn approximately 5%, or $5, each year. Precisely because the principal is never spent, the nonprofit can spend $5 each year indefinitely. After 20 years, the nonprofit has spent $100 and still has the original $100.

Let’s say a donor gives a nonprofit a $100 gift. The donor and the nonprofit want to make the gift last, so rather than spending it all at once, they invest the $100 through the endowment and spend only $5 of the earnings each year. If the nonprofit received a donor gift to spend immediately, the original $100 gift would run out in 20 years ($100 divided by $5 per year equals 20 years). If, however, the nonprofit invests the principal $100 into the stock market, the principal can earn approximately 5%, or $5, each year. Precisely because the principal is never spent, the nonprofit can spend $5 each year indefinitely. After 20 years, the nonprofit has spent $100 and still has the original $100.

Scale up: CC has a $804 million endowment. We invest this principal in various types of investments, including the stock market, and earn roughly 5% ($40 million) per year. We do not spend our endowment; we spend what we earn on our endowment. Just as with the smaller-scale model using $100, this structure ensures that we can make our money last longer than if we spent it like a checking account.

Where does endowment money go?

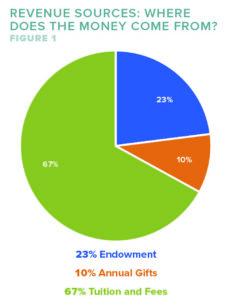

Again, we can’t spend the principal $804 million endowment, but it still brings us 5%, or $40 million, annually. Roughly 23% of our annual operating budget — what it costs to run the school each year — comes from the endowment’s earnings. The rest of the money comes from tuition, room, and board fees (67%), and grants and annual gifts (10%). This means the endowment actually subsidizes the cost of tuition for all students, including full-pay.

Again, we can’t spend the principal $804 million endowment, but it still brings us 5%, or $40 million, annually. Roughly 23% of our annual operating budget — what it costs to run the school each year — comes from the endowment’s earnings. The rest of the money comes from tuition, room, and board fees (67%), and grants and annual gifts (10%). This means the endowment actually subsidizes the cost of tuition for all students, including full-pay.

What is the true cost of a CC education?

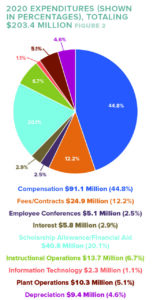

Without the subsidy endowment and annual gifts, the true cost of a CC education is nearly $97,000, well over $20,000 more than the full-pay sticker price (in the 2020-21 academic year, $74,256). The true cost of a CC education is calculated by dividing operating costs (in 2020, $203.4 million) by the number of students (in 2020, approximately 2,100), which totals $96,857, or nearly $97,000 per student. Note: Operating costs include paying our faculty and staff, financial aid, and caring for our grounds and buildings. Charging the true cost would not only make CC inaccessible to students who rely on financial aid but would deter even prospective students and families who could pay the high price. Higher education is a unique nonprofit sector in that there are quasi “customers” (students and families) who compare prices and offerings of various schools, forcing institutions to compete with one another. Because our peer institutions subsidize the cost of tuition for all students, we must do the same to offer a competitive price.

Why isn’t CC need-blind?

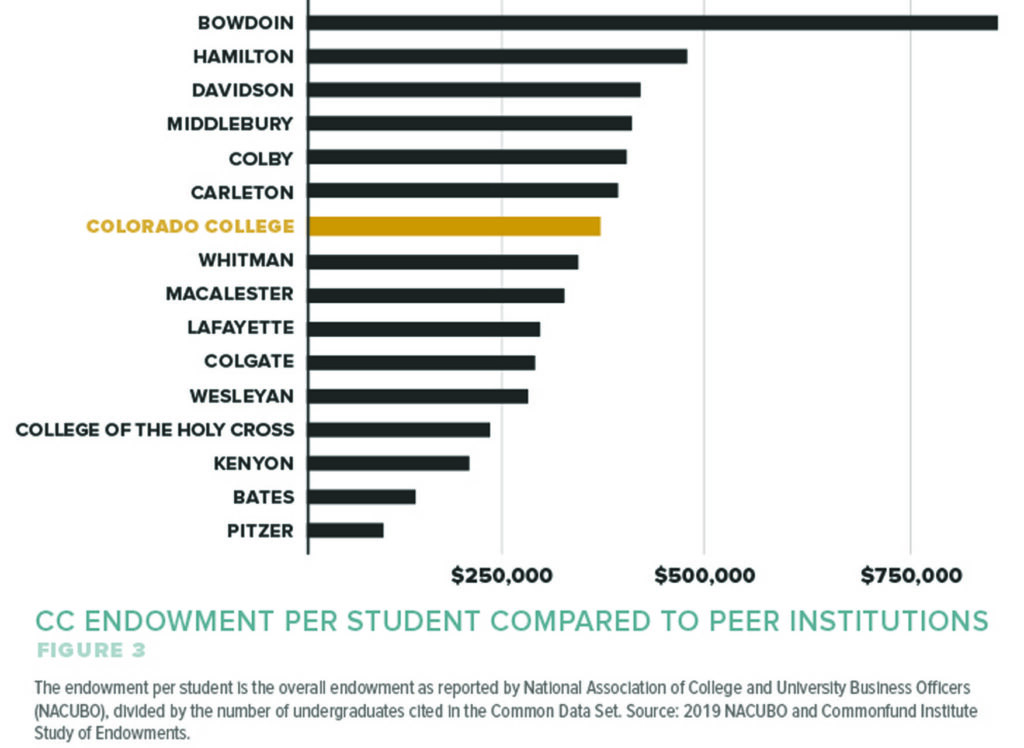

While our endowment has seen remarkable growth (over $300 million) in the last decade, CC’s endowment per student is still significantly less than that of many of our peer institutions. When students compare our financial aid offerings to schools like Princeton University and Williams College, for example, the differences in endowment size must be considered. In the 2018-19 academic year, Princeton’s endowment per student was more than $3 million, Williams’ was nearly $1.4, and CC’s was $373,000. To be need-blind in admissions, CC would need to double its endowment.

This being said, CC is a “meet need” school, meaning that we will meet the demonstrated need of all students who are accepted. While some schools with smaller endowments advertise as need-blind, they “gap” students, meaning they accept students regardless of their demonstrated need, but do not provide a robust financial aid package. Consequentially, these students with need often graduate with large amounts of debt. Only about 25 American colleges and universities are need-blind and meet full demonstrated need.

How can we grow our endowment?

CC’s endowment is smaller than many of our peer institutions because we are notably younger and thus have had less time to receive large gifts and grow our endowment through investments. For example, we are 60 years younger than Colby College (endowment value $869.9 million as of 2018-19) and 80 years younger than Williams College (endowment value of $2.9 billion as of 2018-19).

Additionally, we have significantly lower alumni participation in giving than other schools. As of 2019, the two-year average participation rate (percentage of alumni who have given any dollar amount to their institution in the last two years) among our peer institutions was 36%. CC’s participation rate was 22%. One in three alumni from our peer institutions regularly give to their alma mater, while only one in five CC alumni give to theirs.

Why give to CC?

Giving is a personal decision, and there is no single reason. Many students and young alumni who I have talked to don’t know that when giving to CC, you can decide where your money goes. Whether you want to give to an academic department, financial aid, or your club sports team, the choice is yours. Gifts of every amount make a difference; in 2019 alone, Annual Fund gifts of $250 or less totaled nearly $1 million.

I give to CC because I want future students to access the incredible experience that I have been afforded. I know I will continue to benefit from this education years into the future, whether applying what I’ve learned in CC courses, nourishing lifelong friendships with classmates, or engaging with the CC alumni network to further my professional development. I’m grateful to the CC community, and am honored to give back.